Proving Competitive Intelligence ROI

How do you prove the value of your company’s competitive intelligence program? If you’re like many analysts and CI managers, you most likely fall under one of the following categories:

- It’s hard to justify the cost of CI or proving it’s value in monetary terms

- You can’t get buy-in for CI as a priority over other functions

- The impact of the CI you gather is hard to prove

And maybe you can’t answer these questions:

- Why does competitive intelligence matter?

- Does it drive the company forward?

- Is it saving time and money?

- Is it increasing productivity?

Professionals have been trying to uncover the value for decades, one of the first published guides on proving CI ROI was in 1996 by Jan Herring in his book Measuring the Effectiveness of Competitive Intelligence: Assessing & Communicating:

“Competitive intelligence must be measured to be valued by companies.”

So, how do you demonstrate the value of the CI team output? How do prove that CI benefits the bottom line?

The return on investment of a competitive intelligence program is directly related to the level of competitive maturity of your company. ROI is high when CI helps organisations make better decisions. [Click to tweet this!]

For example, if you have invested enough time and resources to the monitoring, tracking and response of intelligence (level 1), your ROI can be measured in the time spent conducting those activities, and the productivity of the time spent. The more you invest, the more you can measure in terms of return.

ompeteIQ Competitive Intelligence ROI model

Take a look at our competitive intelligence ROI model above. We can see that when a company is at level 1, 2 or 3, the ROI measures are fairly standard and predictable. But a fully mature organization can expect to see an impact on market share and capitalization in return for their CI program investment.

Breaking down the model

At level 1 competitive maturity, a company invests time and money in organizing and informing the company with competitive intelligence. What they deliver to CI users is a way to monitor and track CI, a method of rapid response and internal communication in the form of newsletters. The value of this (ROI) can be seen in productivity terms.

At level 2, the company is now investing resources to win more deals. Their CI system features integration with a CRM system such as Salesforce, and it produces CI tools like battle cards and win/loss analysis. In return, they see a direct impact on revenue.

Level 3 organizations want to go deeper and improve their messaging and positioning as a result of CI. What is delivered to them is their clear USP, where they fit in the market and opportunities for up-sell. In return, the value is in an increased margin.

At level 4, the company wants a strategic planning aid. They want to move into new markets, develop new products and face new competitors as a result of CI. Their ROI is a piece of or an increase in market share.

Fully competitively mature organizations (level 5) engage with a CI system at an executive/board level. Actions taken as a result of CI will be mergers and acquisitions, legal moves and strategic hires. Market capitalization is their return on investment of a competitive intelligence program.

The problem with Competitive Intelligence and ROI

We see two current problems that need to be solved:

- The vast majority of CI individuals don’t believe that it can be measured, don’t believe it should be measured, or simply don’t know how to measure it.

- Many budget holders see it as an overhead rather than a support function.

To overcome this, you need to demonstrate the value of CI by becoming a competitively mature organization.

Should proving ROI be subjective (survey teams to see how it helps them) or objective (hard numbers)?

Both. You should be able to glean insights from the end user of the intelligence, and back these up with hard-hitting metrics like:

- New clients

- Client retention

- Increased revenue

- Time and costs savings

- Market share

- Productivity improvements

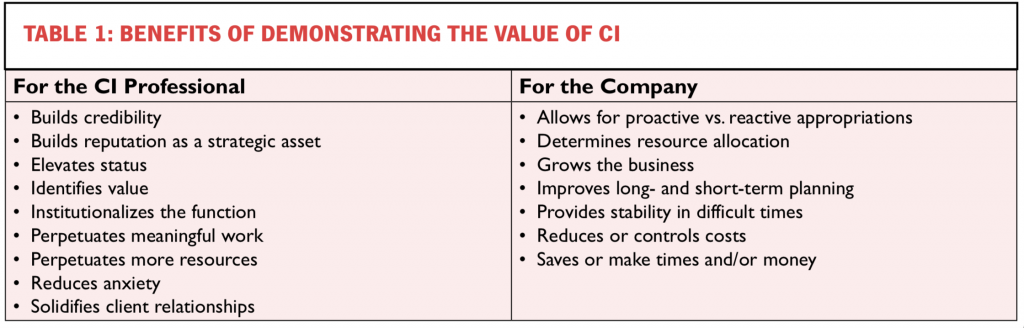

he Benefits of Demonstrating CI Value by Proactive Worldwide

You should arrive at a point of putting a number against CI in your organisation. This number can incorporate revenues gained and revenues ‘not lost’ due to competitor activity, as Robert Flynn outlined in his 1996 Competitive Intelligence Review article.

We can see this in practice today. A recent survey by HBR found that many respondents in the pharmaceutical industry said that the use of competitive intelligence had either saved or generated millions through discontinuing ineffective drug development efforts. They were able to walk away from bad deals and accelerating others based on competitor movements.

Competitive intelligence should not be viewed as an expense or overhead, rather it should be engaged with on an organizational level. To get there, you need to prove it’s value. And once you know what metrics you need to impact with CI, this should become a lot easier.

Talk to us today about getting a tailored CI ROI model for your company.